畅销全球56国的特种门制造商

15062688099

深耕特种卷帘门领域

特种作业持证技术工程师

远销全球国家

国家授权专利

名企应用案例

ExIICT4防爆

ExIICT4防爆级别ExIIC认证,涵盖适用于IIB、IIA防爆要求场所,可定制满足粉尘防爆要求。

无电焊工艺设计,施工安全、高效率、美观。

防爆电气及门体基材均采用国际或国内品牌,品质保证。

ccc认证&

ccc认证&广泛应用于工业与民用建筑的防火隔断区,能有效的阻止火势的蔓延以及高温的传导。无机布基防火隔热类产品获得中国CCC认证以及欧标EN1634-1:2014认证,耐火时间为4小时。

钢质防火隔热类产品获得欧标EN1634-1:2014与欧标EN1634-1:2008双认证,耐火时间有4小时与2小时,已出口新加坡、阿尔及利亚、越南等欧标国家。

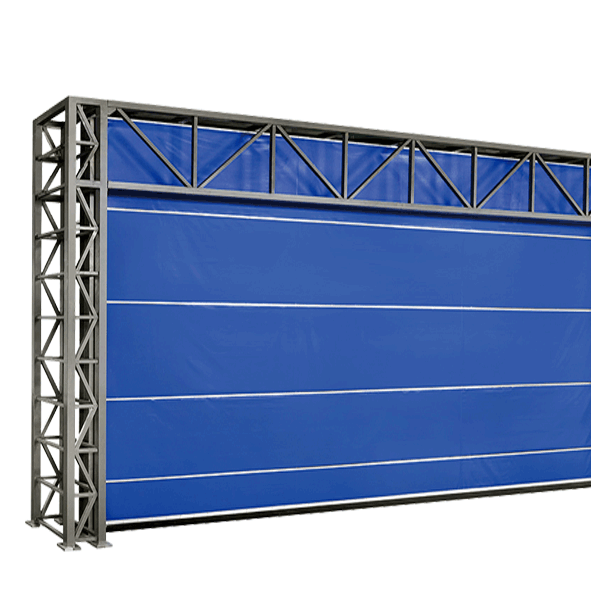

>20米宽度超大门均可定制,抵御15级以上台风

>20米宽度超大门均可定制,抵御15级以上台风

钢结构的强度、挠度、应力及稳定性进行准确的计算和校核,确保产品的可靠性能。优良的抗风性能,抗风压能力值为37.5M/S,可抵御15级以上台风。

负载保护系统、防坠落风锁系统、遇阻停止系统等多项组合安全防护系统,确保安全隐患百无遗漏。驱动系统元器件均采用诺德NORD、西门子、施耐德、三菱等品牌。

优选首钢、宝钢、鞍钢镀铝锌板材,品牌彩涂钢卷,全铜电机,全进口德国诺德电机,西门子变频器等,原材奠定品质。

门轨采用专利降噪耐磨技术,噪音测试50分贝以下,环保、顺滑、耐磨、延长使用寿命。

自带纠偏系统,使用过程中不串片,不会出现门片串动卡住导槽的情况发生。

选配安全气囊,防止门体关闭过程中,不慎压到人或物体时,自动感应切换到停止模式,降低伤害,规避风险。

表面无电焊全铆接工艺,防腐防锈,激光切割,数控液压模冲、更加美观。

选配卷帘门防坠落安全装置,防坠落失误率低,结构简单,门帘在下滑坠落时,可自动刹住。

TORAY东丽(南通)公司认可新恒邦防火卷帘门并签订合作协议,昆山新恒邦防火卷帘...

工业滑升门给力,普利司通常熟工厂温暖过冬。昆山新恒邦门业工业滑升门给力,让普利司...

昆山新恒邦助力中核工业(连云港)改造项目顺利交付,在期限内完成改造任务,对于很多...

昆山新恒邦门业参与奇瑞捷豹路虎汽车(常熟)新建厂房卷帘门项目建设,新恒邦卷帘门有...

新恒邦门业为昆山乐购商场安全经营,保驾护航。昆山乐购商场处于昆山经济圈繁华地带,...

苏州松下生产科技有限公司厂房改造工程携手昆山新恒邦,共创互利新局面。为应对消防改...

特级防火卷帘门走进吉利汽车制造基地,并顺利交付。昆山新恒邦特级防火卷帘门是消防认...

新恒邦门业助力巴斯夫(张家港)工厂改造项目完成,巴斯夫张家港工厂积极响应相关部门...

新恒邦卷帘门参与上海大众汽车有限公司厂房项目建设,新恒邦抗风卷帘门和防爆快速卷帘...

昆山新恒邦作为建议品牌参与四川一汽丰田厂房扩建项目,建议品牌这个词我们可能都不陌...

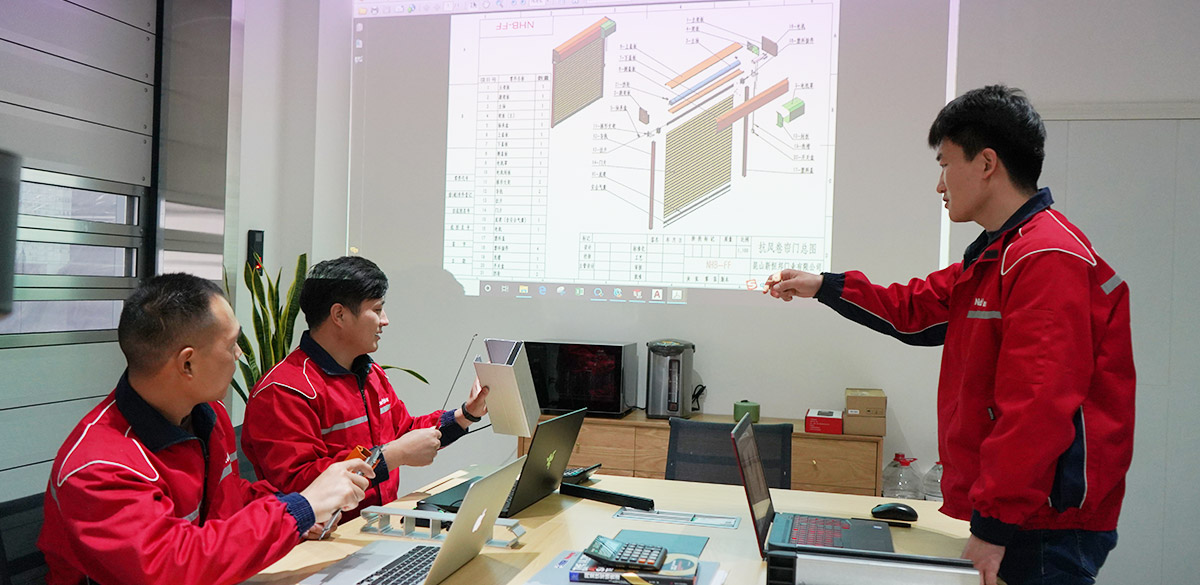

创新研发质优保证

厂家直销非标定制

5000+案例见证有口皆碑

增值配套服务全程无忧

售前:提供现场勘查,图纸深化设计服务。

售中:项目经理全程把控项目进度,搜集意见并提出改进方案。

售后:2小时响应机制,48小时提供解决方案,1年免费保修期。

研发团队12人,特种作业持证人员10人,开发产品获国家授权专利30项,产品通过十多项第三方检测与认证。

特种卷帘门源头生产厂家,13000㎡生产车间,激光切割机、数控折弯机等齐全设备,20万㎡年产能,快至7天供货,支持从外观、功能等维度特殊定制。

产品应用于化工、仓储物流、食品、医药等多个领域,与福建万华、永和化工、奇美化工等世界500强企业均有合作,用口碑征服市场。

近日,江苏省消防救援总队领导一行16人莅临我司调研交流,我司特派销售经理张士昌、技术总工孙曙光负责接待工作。

查看更多随着国际环境的变化和企业发展需求的改变,越来越多的中国企业向泰国转移,但由于对当...

为了提高公司团队凝聚力、向心力和执行力,增进员工感情和配合度,活跃团队气氛,让员...

最近很多朋友都在问我,厂房卷帘门要用铝制还是钢质?在这里统一回复一下大家的问题,...

快速卷帘门哪家好?认准昆山新恒邦门业,21年特种门生产经验,已服务5000+客户...

防火卷帘门电压是380V还是220V?一般情况下,国内的防火卷帘门电压都是380...

纺织厂用卷帘门一般使用哪种呢?推荐使用快速卷帘门系列,门洞较小的可以使用PVC快...

近日,昆山新恒邦门业有限公司与苏州群策科技有限公司签订抗风卷帘门复购合同,为其工...

卷帘门可以安装在机器上做设备配套使用吗?当然可以了,用的比较多的是PVC快速卷帘...

化工厂厂房内部常用的卷帘门,你知道是什么吗?很多在化工厂的朋友肯定见过,就是PV...

铝合金卷帘门是什么样子的?铝合金卷帘门常见的型号有50、77、100、120等,...

涡轮式快速卷帘门是什么样子的?涡轮式快速卷帘门在今年出现了井喷式的增长,生产工艺...

湖北快速软卷帘门抗风吗?快速软卷帘门具有抗风性能,一般可抗6级大风,广泛应用在食...

标准化厂房

年产能

数控生产线